are delinquent property taxes public record

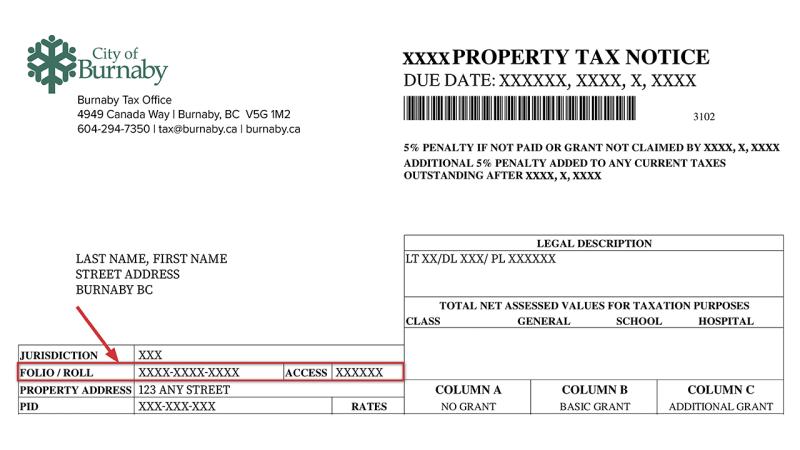

She joined ATC in 2005 and held various positions in the Internal Audits and Property Tax Divisions prior to promoting to her current post. The Tax Office accepts full and partial payment of property taxes online.

Please be advised that we.

. Welcome to the world of Maricopa County Arizonas Tax Liens. Notice of Delinquency - The Notice of Delinquency in accordance with California Revenue and Taxation Code Section 2621 reminds taxpayers that their property taxes are delinquent and will default on July 1. Toll-free in Massachusetts Call DOR Contact Toll-free in Massachusetts at 800 392-6089.

Pacific Time Monday through Friday excluding Los Angeles County holidays. The county appraiser values the property and the county clerk sets the tax levy and computes the tax amount due. When delinquent or unpaid taxes are sold by the Cook County Treasurers office at an annual sale or scavenger sale the Clerks office can provide you with an Estimate Cost of Redemption detailing the amount necessary to redeem pay your taxes and remove the threat of losing your property.

The Tax Lien Sale provides for the payment of delinquent property taxes by an investor. Once you receive the certified document from our office you can then make an appointment with the Register of Deeds to record the document or mail the certified document to them. Pursuant to Arizona Revised Statutes Title 42 Chapter.

Ad Enter Any Address and Find The Information You Need. See Property Records Tax Titles Owner Info More. Degree in Business Administration with a concentration in Accounting from California State University San.

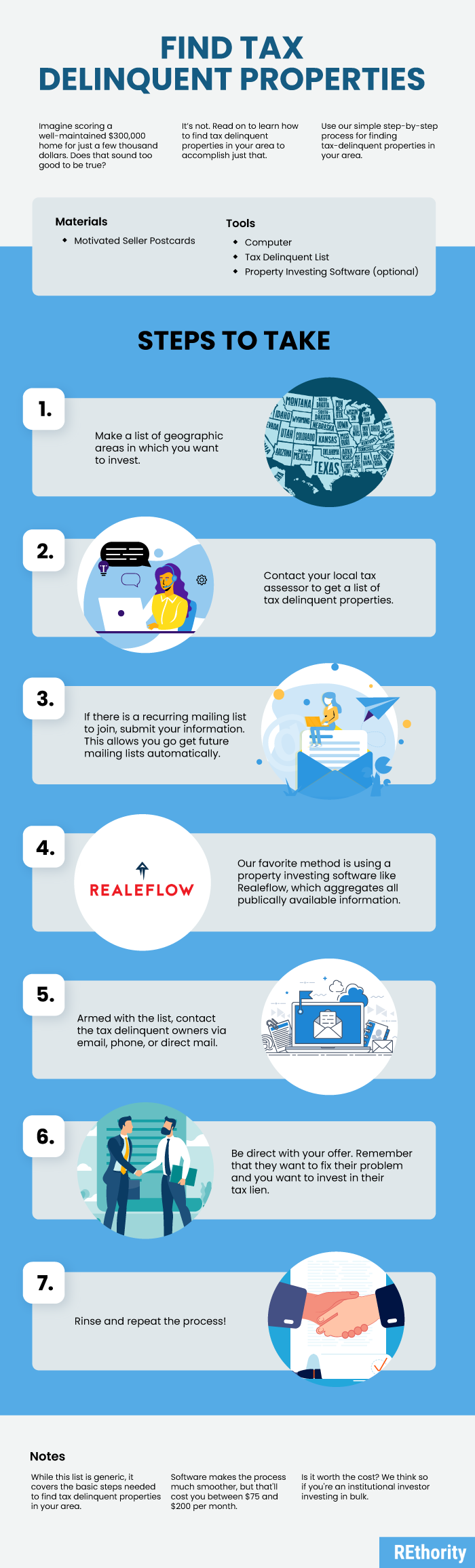

View the tax delinquents list online. Delinquent Property Tax Search. Search Valuable Data On Properties Such As Liens Taxes Comps Foreclosures More.

Property information may be obtained by visiting the following pages. For real estate property. Postmark date is not proof of payment once a tax is delinquent.

We will issue a tax lien release once your Unsecured Property Tax Bill is paid in full. Once a property tax bill is deemed delinquent after March 16th of each year a 15 past due penalty is added to the bill and the bill is sent to the Delinquent Tax Office. Tax Defaulted Land Sales.

For an official record of the account please visit any Tax Office location or contact our office at 713-274-8000. Visit Our Official Website Today. Eventually the lien owners may have to force foreclosure on the property to pay the liens.

If you have delinquent taxes due you will receive your uncertified document back with your check and a tax statement showing the delinquent taxes due. 9 am4 pm Monday through Friday. At that point you could take possession of.

Tax Department Call DOR Contact Tax Department at 617 887-6367. Search Any Address 2. The Clerks office also provides calculations of delinquent taxes owed.

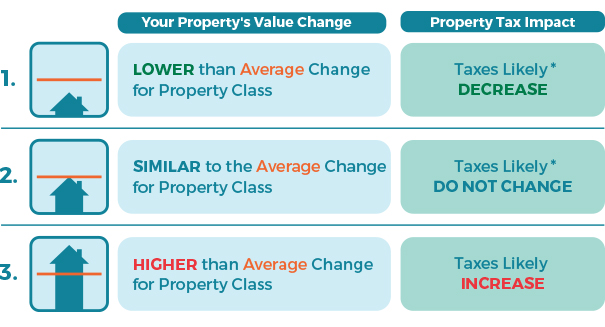

The Harris County Delinquent Tax Sale is the monthly public auction of real estate for past due property taxes This site can be used to make online payments to the King William County Treasurers Office and inquire into tax ticket information from the comfort of your home or office Annual Tax Lien Sale The information is uploaded to this server. Delinquent tax records are handled differently by state. The specifics about each countys sale along with a listing of each certificate of delinquency are required to be advertised in the local newspaper at least 30 days prior to the tax sale date.

This means that after giving official notice of the pending sale the property will be sold at a public auction or acquired by a public agency if you do not pay the taxes before the date on which the property is offered for sale or. Get In-Depth Property Reports Info You May Not Find On Other Sites. In each of the examples above the county could initiate foreclosure against the real property in question after the taxes become delinquent on January 6.

Please submit a REAL PROPERTY REFUND REQUEST INQUIRY FORM to report any errors in the property records or to submit questions or comments for the Fiscal Officer. If payment is not received or United States Postal Service USPS postmarked by June 30 on July 1 a 15 redemption fee will be. Property taxes become due November 1 and are delinquent if not paid by April 1 of the following year at which time 3 interest and advertising cost are added.

The tax on the property is auctioned in open competitive bidding based on the least percent of interest to be received by the investor. Delinquent property tax cannot be paid online. If a certificate of delinquency is sold to a third party purchaser the property owner.

Delinquent payments must be received on or before the last working day of the month to be considered paid in that month. Tax Receipts can be found on the current statement page or by clicking. Property taxpayers may use credit cards debit cards or e-Checks to pay their taxes.

2JEFFERSON The Ashtabula County Treasurers Office concluded its 2022 tax collection securing a record-breaking 110 million in. Typically a tax lien is placed on the property by the government when the owner fails to pay the property taxes. Failure to receive a tax bill on your property will not relieve you from paying taxes or subsequent penalties which are imposed.

An additional 30 fee will be added to all real property bills and an additional 40 fee will be added to all mobile home bills if the taxes penalties and assessment fees are not paid by 500 PM on Friday April 22 2022. Room 150 County Government Center 701 Ocean Street Santa Cruz California 95060. Property tax is delinquent on April 1 and is subject to penalties and interest.

Welcome to the Cuyahoga County Property Information Web site. Linda Santillano has served as Property Tax Division chief since October 2017. The certificates of delinquency are also listed on the county clerks website at least 30 days prior to the sale.

She holds a BS. Your taxes can remain unpaid for a maximum of five years following their tax default at which time your property becomes subject to the power of sale. The amount due on delinquent payments is determined by date received not by postmark.

Contact for View the Public Disclosure Tax Delinquents List. View Santa Cruz County tax defaulted land sale information and property list when available. If left unpaid the liens are sold at auctions to the public.

Remember that regardless of record ownership delinquent taxes on real property may always be collected through foreclosure on the real property itself. The county treasurer mails out tax statements to the owner of record on or after the first of November of each year and is responsible for collecting the taxes due including any special assessments and fees. Santa Cruz County Treasurer and Tax Collector.

If your unpaid taxes have been sold at an annual tax sale scavenger sale or over the counter the Clerks office can provide you with an Estimate Cost of Redemption detailing the amount necessary to redeem pay your taxes and remove the threat of losing your property. If you have paid your bill in full and have not received your tax lien release you may contact us at unsecuredttclacountygov or 213 893-7935 between 800 am.

How To Find Tax Delinquent Properties In Your Area Rethority

Frequently Asked Questions Property Taxes City Of Courtenay

Secured Property Taxes Treasurer Tax Collector

11 Things You Need To Know About Property Tax 2022

Unsecured Property Tax Los Angeles County Property Tax Portal

Adjusted Annual Property Tax Bill Los Angeles County Property Tax Portal

How To Find Tax Delinquent Properties In Your Area Rethority

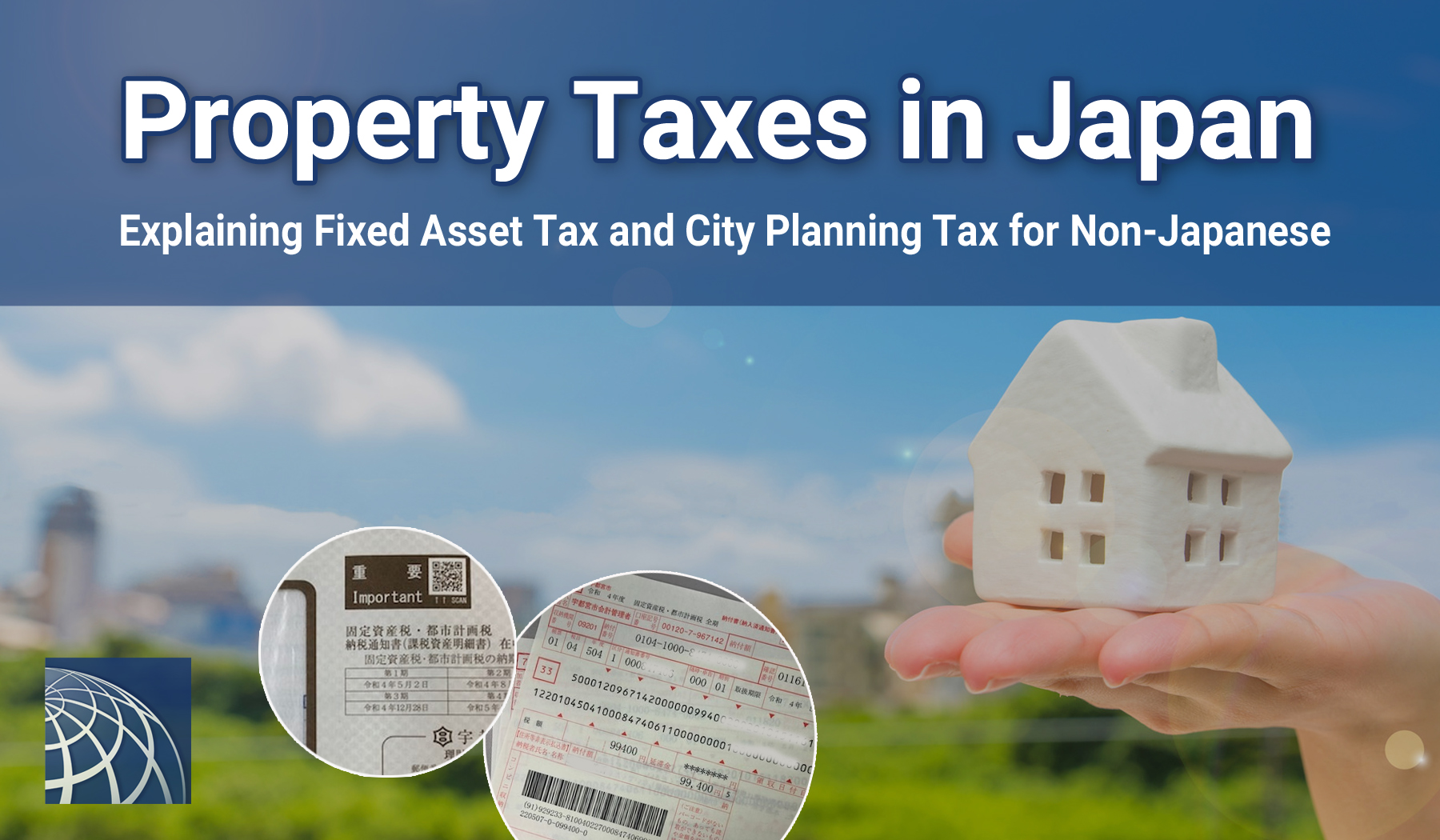

Property Taxes In Japan Explaining Fixed Asset Tax And City Planning Tax For Non Japanese Plaza Homes

Secured Property Taxes Treasurer Tax Collector

6 Things To Know About Property Titles

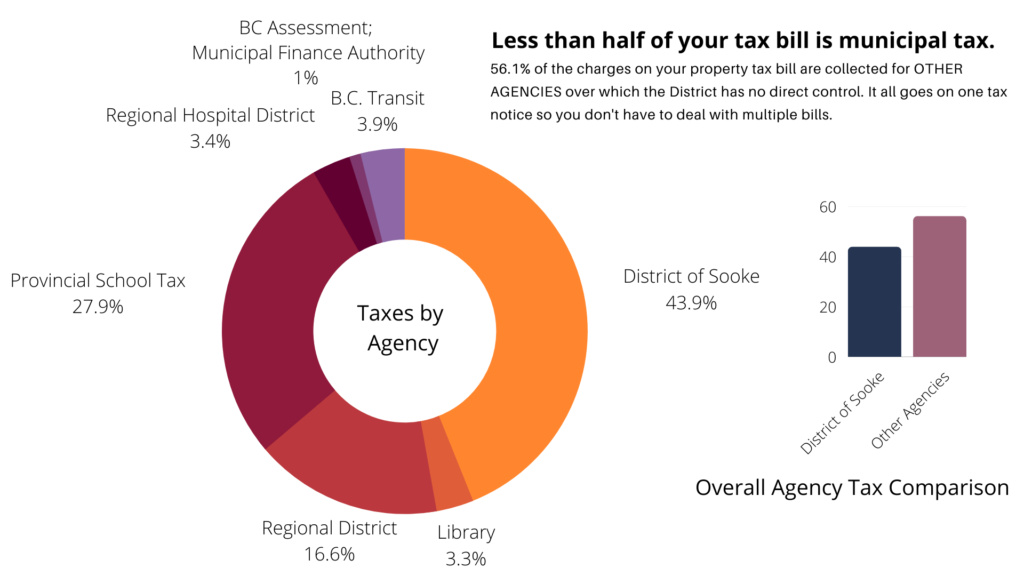

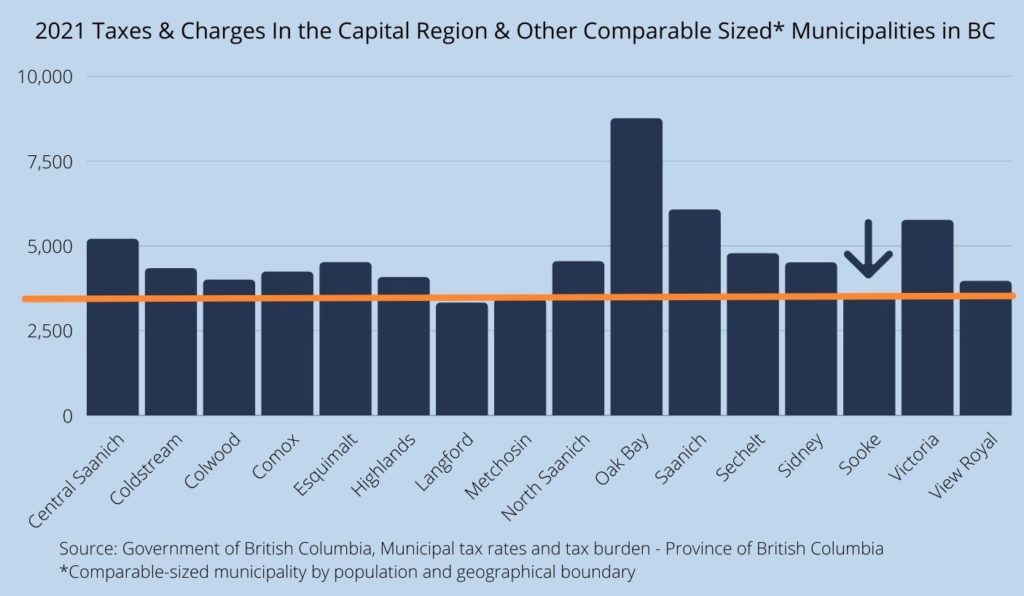

Overview Of Sechelt Property Taxes