hawaii capital gains tax increase

The income brackets are currently taxed at 11. Capital losses on the sale of this stock do not need to be added back to income.

The bill has passed the Senate and awaits action in the House.

. Host Kelii Akina and guest Tom Yamachika in Tax Hikes at the 2022 Legislature. House lawmakers have passed their own legislation raising the capital gains tax. The bill has a defective effective date of July 1 2050.

Multiple versions of this initiative were filed and cleared for signature gathering. Long Term Capital Gains Tax Brackets for 2021 It should also be noted that taxpayers whose adjusted gross income is in excess of 200000 single filers or heads of household or 250000 joint filers may be subject to an additional 38 tax as a net investment income tax. Total capital gains are then reduced by the qualifying capital gains on line 4 or line 13.

If the bill ultimately passes Hawaii will overtake California as the state with the highest income tax. California is currently the state with the highest income tax rate in the nation at 133 for individuals earning more than 1 million a year. The Grassroot Institute of Hawaii would like to offer its comments on SB2242 which seeks to create additional tax brackets thus raising the states top income tax rate from 11 to 13.

Capital gains tax in Hawaii is set to increase to 11 percent if legislation is passed currently. Lines 5 and 14 - Section 235-7a14 HRS Short-Term and Long-Term Capital Gain Exemp - tionFor tax years beginning after 2007 and end-. The bill will now go to the House for consideration.

Hawaii Together Feb 14 2022. Tax Law and Guidance Hawaii Taxpayers Bill of Rights PDF 2 pages 287 KB October 2019 Tax Brochures Tax Law and Rules Tax Information Releases TIRs. Capital Gains REIT Revenue Tax Credits.

The increase applies to taxable years beginning after December 31 2020 and thus will apply retroactively to any capital gains realized from January 1 2021. Line 14 using the Tax Table Tax Rate Schedules Capital Gains Tax Worksheet in the Instructions for Form N-11 or Form N-15 or Form N-168 whichever. Californias rate is 133 on those earning.

The current top capital gains tax rate is 725 percent which critics point out is a lower tax rate than many Hawaiʻi residents pay on their. General coverage of federal laws that are relevant to Hawaii income tax or Hawaii estate tax Unreported Tax Court Decisions Tax Audit Guidelines. 1 increases the Hawaii income tax rate on capital gains from 725 to 9.

For those filing singly the bill would enact a higher capital gains tax for those making as little as 24000 a year. Increases the personal income tax rate for high earners for taxable years beginning. Capital gains and corporate income taxes would.

Hawaiis 16 rate would apply to those earning more than 200000 a year. The bill would also repeal certain GET exemptions from July 1. The capital gains tax is imposed on the profits from sales of capital assets such as houses stocks bonds or jewelry.

In reality tying the capital gains rate to the income tax rate makes this a tax increase at the level of joint taxpayers making more than 48000 annually. Detailed Hawaii state income tax rates and brackets are available on this page. Further it would increase the capital gains rate from 725 to 11 and impose a single rate for the corporate income tax at 96.

Why the Push to Increase Hawaii Taxes. The Hawaii income tax has twelve tax brackets with a maximum marginal income tax of 1100 as of 2022. If enacted this bill also would increase the capital gains tax from 725 to 11 and hike the corporate income tax rate and income tax rates on investment companies and real.

The bill would increase the tax on capital gains to 11 from 725 and increase the corporate income tax rate to 96. Under current law a 44 tax. On the next page you will be able to add more details like itemized deductions tax credits capital gains and more.

7 rows Report Title. Please remember that the income tax. Law360 January 25 2021 200 PM EST -- Hawaii would increase the states tax on capital gains to 9 under a bill introduced in the state House of.

The tax rate would jump from 11 to 16 percent for individual filers making over 200000 a year or for household heads making 300000 or more. Also keep in mind that the long-term capital gains rate for. Hawaiʻi lawmakers advance capital gains tax increase.

The bill would also increase the capital gains tax rate from 725 to 11 impose a single rate for the corporate income tax at 96 repeal certain GET exemptions from July 1. Raise Revenue Tax Fairness. While well-intentioned this bill would increase the states reliance on a poorly-structured tax with no guarantee that the dedicated money would actually solve the.

The initiative would make changes to the states code governing capital gains taxes. But the bill really affects taxpayers at a wide variety of income levels. Digest of Tax Measures.

The Washington Capital Gains Tax Changes Initiative 1934-1938 may appear on the ballot in Washington as an Initiative to the People a type of initiated state statute on November 8 2022. The state House on Thursday approved bills to raise the inheritance or estate tax and also voted to increase the state capital gains tax. Hawaiis Senate Bill 1474 would raise the states sales tax from 4 percent to 45 percent to provide 350 million in a dedicated education fund.

Hawaii legislators are aiming to increase taxes on fuels property and capital gains but that might be more trouble than its worth according to Tom Yamachika president of the Tax Foundation of Hawaii.

Property Investment Returns Are They Worth The Effort Wealthy Healthy Life Investing Investment Property Buying Investment Property

Middle Class 2030 Graphing Middle Class Class

How Far Will Dollar Stretch Real Value Of 100 In Each State Revealed Map Usa Map Cost Of Living

Harpta Maui Real Estate Real Estate Marketing Maui

Nar Released A Summary Of Existing Home Sales Data Showing That Housing Market Activity This December Fell 3 6 Perce Sale House Surveying Real Estate Marketing

Endangered Species Endangered Species Infographic Endangered Species Endangered

Pin By Amanda Johnson On Local Map Of Delaware Map State Map

Do The Political Economic Social Cultural Technological And Environmental Or Pestle Analysis Factors South Africa Travel South Africa Visit South Africa

How Far Will Dollar Stretch Real Value Of 100 In Each State Revealed Map Usa Map Cost Of Living

State By State Guide To Taxes On Retirees Social Security Benefits Retirement Retirement Strategies Map Diagram

Monday Map State Local Property Tax Collections Per Capita Property Tax Teaching Government Map

If You Need To Do A Fast Comparative Market Analysis Form And Have Three Comparable Properties Here 39 S A Cma To M Cma Comparative Market Analysis Marketing

Insider Tips To Conquering Peru S Classic Inca Trail To Machu Picchu Hike Machu Picchu Hike Inca Trails Picchu

See Which States Do Not Have Income Tax Sales Tax Or Taxes On Social Security Start Packing Income Tax Tax Sales Tax

The Difference Between Sales Tax And Use Tax Affordable Bookkeeping Payroll Sales Tax Tax Bookkeeping

What Are Rsus On Form W 2 Tax Time Tax One Page Resume

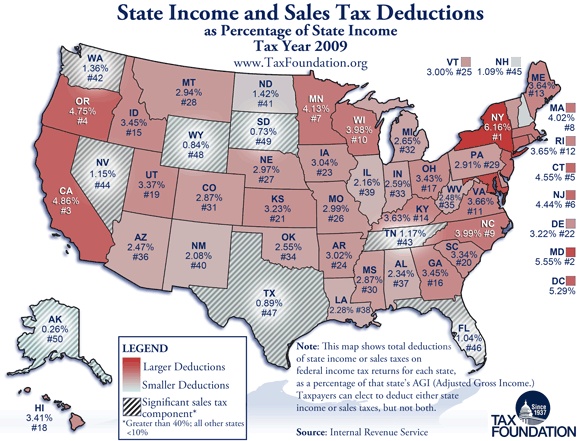

Monday Map State Income And Sales Tax Deductions Data Map Map Map Diagram

Crouching Lion Trail Is A 0 4 Mile Out And Back Trail Located Near Kaaawa Hawaii That Offers Scenic Views The Trail Hawaii Travel Scenic Views Nature Travel